What Is “Mortgage Insurance” And How Does It Benefit You?

johnny • March 14, 2014

WITHOUT IT, MOST FIRST TIME BUYERS WOULD STILL BE RENTING. HERE’S WHY….

When people hear about mortgage default insurance (often referred to as CMHC fees) they have a negative reaction. People often assume that it is the type of insurance that can be declined, such as life or disability insurance. And of course, most people are against having additional fees added to the cost of purchasing a new home. But, mortgage default insurance is actually a good thing. It allows people to purchase a home with less than 20% of the purchase price as a down payment. Since most people put less than 20% down on their first home purchase, many of us wouldn’t be able to buy a home without mortgage default insurance.

Although mortgage default insurance is commonly referred to as “CMHC fees”, there are 3 providers of mortgage insurance in Canada: CMHC (www.cmhc.ca), Genworth (www.genworth.ca) and Canada Guarantee (www.canadaguarantee.ca). But, you don’t have to decide between these providers, all of these companies offer the same service and the same rates.

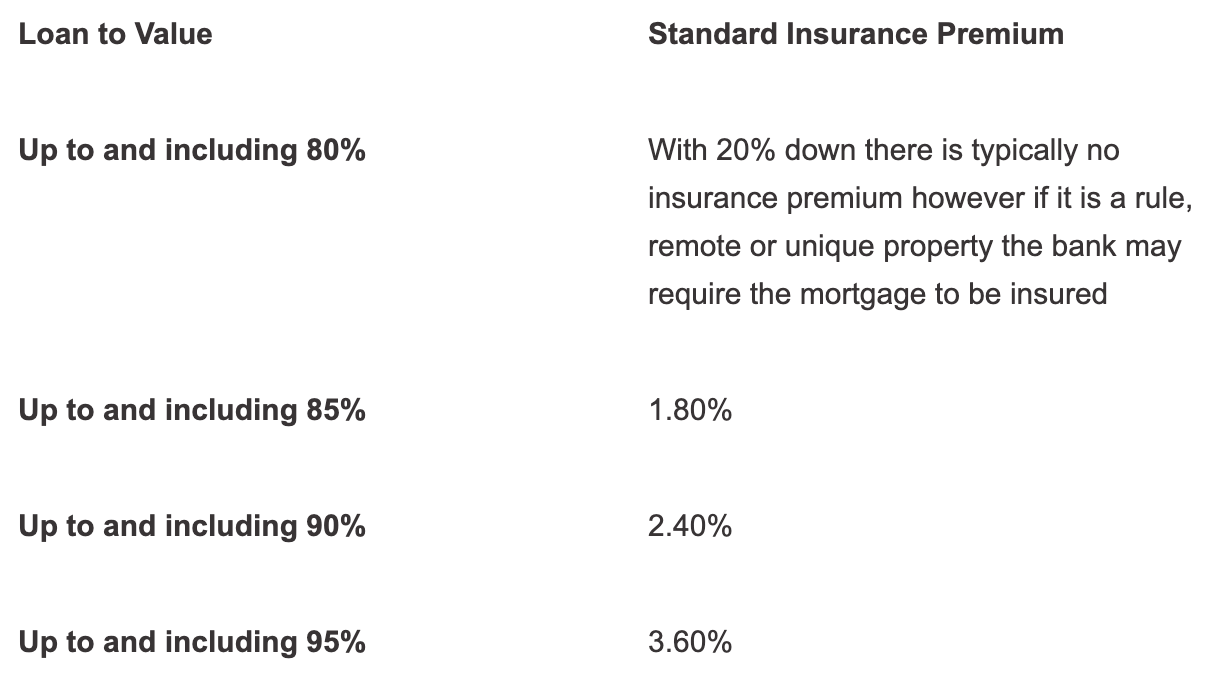

Mortgage default insurance is a ONE-TIME COST that is added to your mortgage. The amount of insurance you pay depends on how much you put as a down payment. The more money you put down, the less risky it is for the bank to loan you the amount of your mortgage, so the less you pay in mortgage insurance. The chart below shows how the cost of the insurance is calculated (if you’re having trouble understanding, call us anytime and we can help!):

For example, if you put 5% down on a $300,000 home, your CMHC fees would be as follows:

Purchase price: $300,000 –$15,000 (5% down payment) = Mortgage requirement of $285,000

$285,000 mortgage X 3.6% Mortgage default premium = $10,260 plus 8% PST ($820.80) = $11,080.80.

You are charged PST on your mortgage default insurance, but the good news is that only the PST portion has to be paid out-of-pocket by you on the closing date. The remainder, in this example the $11,080.80 is added to your mortgage.

In short, mortgage default insurance is an additional cost you need to consider when purchasing a home with less than 20% down, but the benefit is that it allows you to purchase a home for as little as 5% down

Top Factors to Consider When Choosing a Mortgage Broker in Canada In Canada, buying a house can be exciting yet daunting, especially when thinking of the best mortgage to choose. One of the best ways to make this process easier is by engaging an experienced mortgage broker in Canada. These are professionals who work by connecting you to lenders so that you can find the best loan option available for you. Their vast knowledge of the mortgage sector enables them to help you get the best offers possible. But how do you go about choosing the right mortgage broker from the many available? Factors to Consider When Choosing Mortgage Brokers: Looking to choose mortgage broker? Here are the factors to consider: 1. Experience and Expertise In terms of mortgage broker factors , choosing a mortgage broker, the first important aspect to examine is their experience. This is because the Canadian mortgage sector is quite multifaceted with many laws, rules, and lender union characteristics. An experienced broker is likely well versed in these intricacies and will provide such advice depending on individual financial capabilities. Ask for how long they have been in the business and how many clients they have successfully assisted. Also, a seasoned mortgage loan officer usually has established relationships with many lenders, which in turn will offer better options for you. Most of the time, even more useful information will be when a mortgage broker works in a particular niche. For example, first time home buyer Burlington or the local property market of Hamilton or Milton would be niches where the expertise will come in handy. Need help to choose the best mortgage broker in Canada? Contact us at Loewen Group to get mortgage broker tips and services. Call (289) 337-4029 or start here . 2. Range of Lenders and Products An adept mortgage brokerage firm must have access to several lenders as well as different mortgage options. It is because mortgage broker in Hamilton are on good terms not only with banks and credit unions but also with private lending firms, so they will definitely help in finding the most suitable loan according to the client’s needs as well as their financial capabilities. Also, it is more likely that favorable terms for the loan and adequate interest rates are available when a broker has contacts with several lenders instead of one or two. Ask the broker what type of lenders they work with. Brokers with a larger network tend to be able to provide more options than those who are limited to a few lenders. Be sure also to ask if they have such product capabilities or that they have worked with certain types of lenders. 3. Reputation and Reviews Research and analyze the feedback on the best mortgage broker in Canada. Look for online appraisals on Google, social networks, and other further sites, as well as testimonies of their previous clients. An ideal mortgage broker will always have great reviews from clients who appreciate the broker’s skill and results. If family members, friends, or coworkers have ever used the services of a specific broker and were pleased with the outcome, do not hesitate to request contacts. It is more likely that a trustworthy and reputable mortgage broker in Hamilton, Milton, or Burlington will provide great service and navigate you through the mortgage process seamlessly. 4. Knowledge of Government Programs and Incentives Canada has many programs designed to help young starters, in particular first-time homebuyers. A good broker would know these plans and help you make use of those available to you. For instance, should you be purchasing in Burlington, Hamilton, or Milton, they may know of local initiatives in Ontario such as the Home Buyers’ Plan HBP or even the First-Time Home Buyer Incentive. Ask the potential brokers if they are aware of the schemes and if they have helped clients to access them in the past. You can save on expenses and eschew difficulties in buying a home by engaging the services of a broker who is knowledgeable about government support programs. 5. Local Market Knowledge Market research at the local level can considerably impact one’s decision on acquiring a property. Be it Burlington, Hamilton, Milton, or any other area, a mortgage broker Milton with extensive experience in the given region will be aware of the community features, range of the properties, and prevailing tendencies that affect the mortgage or home buying schedule. He or she probably has turned into contacts with banks, appraisers, and real estate agents, thus further shortening the time frame. Conclusion A crucial first step in the home-buying process is selecting the appropriate mortgage broker Burlington . You may discover a broker who meets your demands and will strive to get you the best mortgage by taking into account elements like experience, reputation, variety of lenders, customer service, and local knowledge. Taking the time to do your homework and make an informed decision can make all the difference, whether you're a first-time purchaser in Burlington, searching for the finest mortgage broker tips, or considering your alternatives in Milton. A knowledgeable, experienced broker will help you comprehend your alternatives, walk you through the mortgage process, and make sure your mortgage fits your long-term financial objectives.